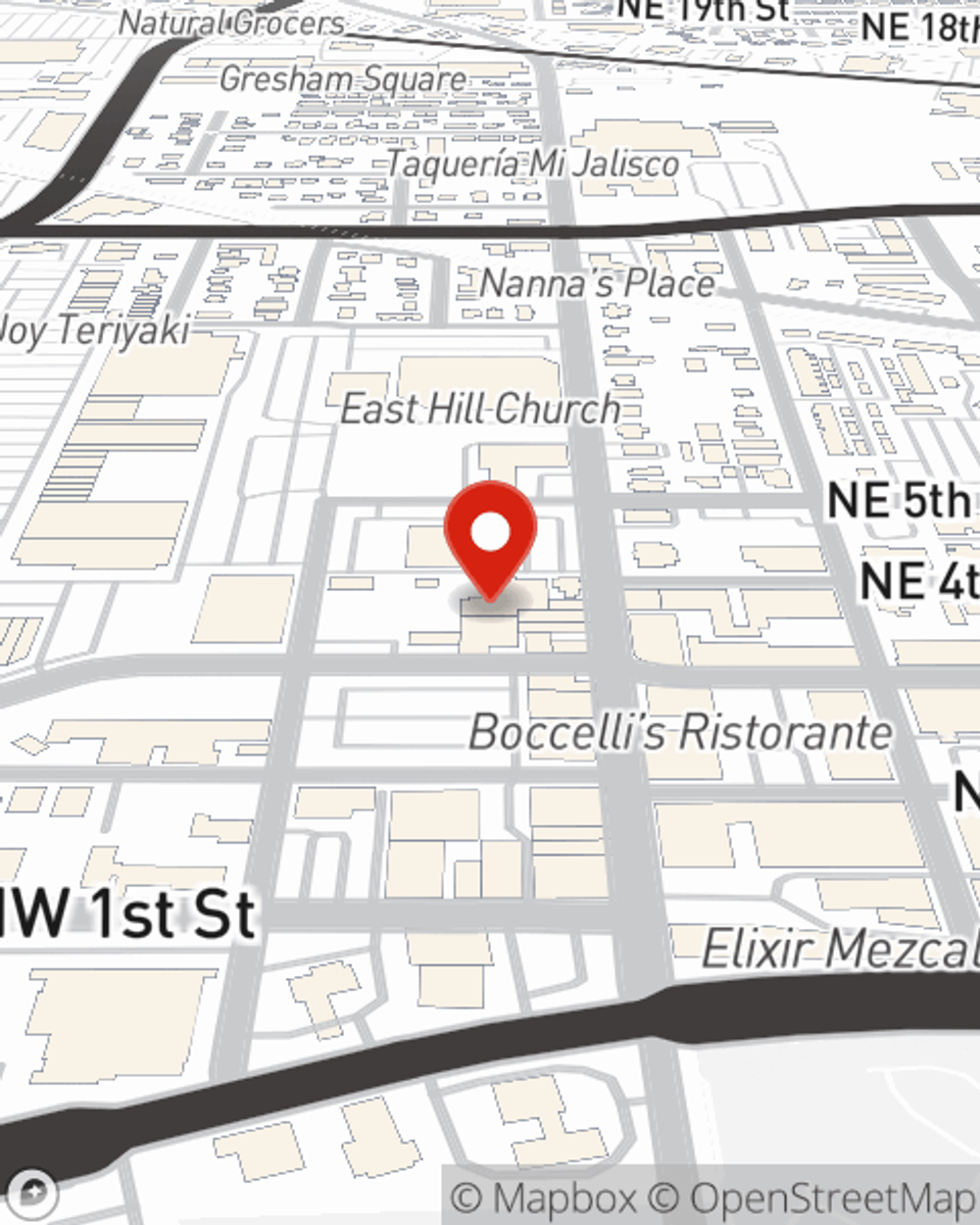

Homeowners Insurance in and around Gresham

Homeowners of Gresham, State Farm has you covered

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance doesn't just protect your house. It protects both your home and your precious belongings. If your home is affected by a fire or a tornado, you could have damage to some of your possessions in addition to damage to the home itself. Without adequate coverage, the cost of replacing your items could fall on you. Some of your belongings can be replaced if they are lost or damaged outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

Homeowners of Gresham, State Farm has you covered

Help protect your home with the right insurance for you.

Safeguard Your Greatest Asset

Navigating the unexpected is made easy with State Farm. Here you can personalize your policy or submit a claim with the help of agent Brad Hornback. Brad Hornback will make sure you get the individual, excellent care that you and your home needs.

Ready for some help exploring your specific homeowners coverage options? Get in touch with agent Brad Hornback's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Brad at (503) 912-3777 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.

Brad Hornback

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.